US Central Bank Fears Trade War is Rattling Global Economy

WASHINGTON – Looking at it from the outside, the U.S. economy probably appears to be the picture of health. A soaring stock market, unemployment levels at historic lows, and strong growth combine to create the impression of a global powerhouse.

“Our economy is the envy of the world,” President Donald Trump asserts. “Perhaps the greatest economy we’ve had in the history of our country.”

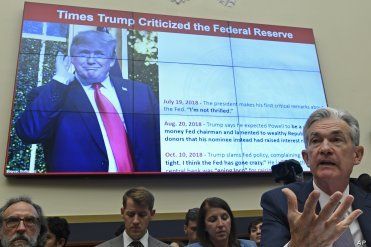

That’s why it may have felt odd to see Federal Reserve Board Chairman Jerome Powell confirm last week that the U.S. central bank will be lowering interest rates this year, beginning as soon as the end of this month. Rate cuts, of course, are typically deployed when the Fed wants to pump up a flagging economy.

Global markets

Powell’s two days of congressional testimony sent a thrill through global markets, but the temporary elation of investors belies a number of pressing concerns about the U.S. and global economies that have the Fed chair and his fellow policymakers very concerned. These include, but are not limited to, the continued trade war between the U.S. and China, the pronounced economic slowdown in China and a looming debt ceiling crisis in the U.S.

The question casual observers were asking themselves last week was, “Why would the central bank want to lower rates when the economy looks so strong?”

Part of the reason stems from what’s known as the Fed’s “dual mandate.” The central bank is charged with controlling inflation and keeping the economy as close to full employment as possible. The latter goal is, right now, probably as close to being achieved as it is ever likely to be. But the former has become a problem. U.S. inflation rates have been lagging well behind the 2% per year rate that the Fed believes is healthy.

In response to reporters’ questions Friday, Federal Reserve Bank of Chicago President Charles Evans echoed Powell’s suggestion that rates are coming down.

“Because inflation expectations seem to be below our 2% objective and it’s been stubborn … it tells me our current setting for policy is on the restrictive side,” he said. Like Powell, Evans sits on the committee that makes decisions about U.S. interest rates.

Trade war

Digging deeper into Powell’s remarks, it wasn’t hard to identify other economic concerns weighing on him — as well as pressure from Trump to lower interest rates.

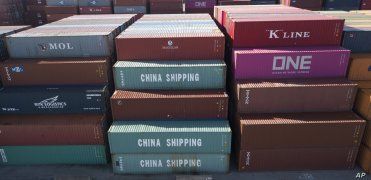

The Trump administration is still battling China over trade, with punishing tit-for-tat tariffs in place that are driving up prices for U.S. consumers and driving down demand for some U.S. goods.

Washington and Beijing announced a truce of sorts last week and said more talks are being planned. But negotiations between the two economic giants have so far failed to produce significant results.

“The bottom line for me is the uncertainties around global growth and trade continue to weigh on the outlook,” Powell told the House Banking Committee last week. He said that the plan to resume talks is a “constructive step,” but added, “It doesn’t remove the uncertainty that we see as overall weighing on the outlook.”

The trade war between the U.S. and China may have taken on even greater significance for the global economy with the revelation over the weekend that the Chinese economy is now growing at the slowest pace it has seen in nearly 30 years.

China’s economy

Growth estimates from the Chinese Communist Party-controlled government are typically viewed with some skepticism by trade economists, but even those numbers signal bad news for China’s massive economy.

In the second quarter, it grew 6.2% — far below the kind of numbers it was hitting just a few years ago. There is also speculation that the second-quarter figure was buoyed by a surge in government spending in the spring that won’t be replicated in the second half of the year.

It’s difficult to judge just how much of the slowdown in China is the result of the tariffs that the Trump administration has imposed, though there is evidence they have hit hard. Exports in June were down 1.3% year-over-year, and imports fell by a surprising 7.3%.

In a report issued Wednesday, the International Monetary Fund estimated that the trade fight could cost the global economy $455 billion next year.

However, there is also the possibility that the numbers reflect factors beyond the ongoing trade war, including the possibility of a regional slump. Last week, Singapore reported an unexpected 3.4% annualized contraction in its second-quarter GDP. Similarly, South Korea, another regional economic dynamo, reported a GDP contraction in the first quarter.

Debt-ceiling worries

Closer to home, Powell and his colleagues are also watching warily as Congress allows the federal government to creep perilously close to its debt limit, a cap on borrowing that can only be lifted through legislative action.

A fairly unique feature of U.S. fiscal policy, the debt limit places a hard ceiling on the amount of debt the federal government can have outstanding. Ironically, this means that as Congress continues to pass budgets that spend more money than the government takes in from taxes, fees and other sources, lawmakers must periodically vote to allow federal agencies to spend the money that Congress itself obligated them to spend.

Battles over the debt ceiling are always worrying to the Fed because they have the potential to result in a U.S. Treasury debt default. The fallout from such a scenario would not only be economically catastrophic, Powell warned, its full effect would also be impossible to predict.

“I wouldn’t be able to capture the range of possible negative outcomes from that,” he told Congress.

Tags

Chinese Communist Partyus china tradechina shipping companytrump china tradebad news for china economytrump tariffs on chinafederal reserve bank of chicago 2020 Dems Grapple with How To Pay for ‘Medicare for All’Next PostRussia’s Putin Says He ‘Sympathized’ With Trump Before US Election

2020 Dems Grapple with How To Pay for ‘Medicare for All’Next PostRussia’s Putin Says He ‘Sympathized’ With Trump Before US Election